Impact & Responsible Investing

There is a huge gap between Impact Investors and investable opportunities, and the world's growing High Net Worth Individuals are not active enough in the impact investing sector.

Impact Investment or Responsible Investing is not yet mainstream, however, Investors, Family Offices and Traditional Philanthropy are changing their approach to investing and giving, but not sure how to deliver the greatest impact.

Wealth managed by millennials need support building impact portfolios, and Impact based enterprise needs support connecting to capital, commercialising and scaling. More enterprises want to deliver financial returns and social or environmental impact, but a lack of skilled and sizeable impact funds or products for investors to invest in is a barrier to impact at scale.

ESG / SRI is sometimes too broad for some impact investors and measurement and reporting can be inadequate if not done right.

Potential, why now?

Impact investing has tremendous potential to help address some of our most entrenched societal issues. Countries, including Australia, face growing gaps between demand for social services and what governments can afford. As a result, governments, businesses and communities are now seeking new solutions, as well as effective new ways to finance and deliver them at scale.

Impact Investing is gaining momentum across the globe, Australia is still ranking low and been a little slow to adopt, however, the shift is coming, and fast. We will be positioned as a thought leader and have exclusive, quality deal flow and capital investment funds ready to invest rapidly.

Emergence of Impact Investing

Impact investing is a growing field of investment that intentionally creates positive social or environmental impacts as well as a financial return, and measures both. It challenges the long-held view that social and environmental issues are best addressed through philanthropic donations, and that market investments should focus exclusively on achieving financial goals.

Impact investing combines the best of both capital and values-based principles to create a triple-bottom line: good financial, social and environmental returns.

Scaling Enterprise and Impact

Social Enterprise and purpose-driven business are quickly emerging as alternative business models. Millennials are driving change with their spending power and need to see impact.

Founders of impact businesses lack commercialisation skills and capacity for rapid scale.

Vast amounts of capital is required to create any scalable social and environmental impact.

Connecting investable deals with capital is difficult and time consuming requiring specific expertise.

Building Enterprise Capacity

We recognise that there are many purpose-driven businesses seeking investment, and that correspondingly there are investors looking to grow the impact sector alongside their portfolio. IIF connects investee’s looking for impact investment with investors seeking to create impact through their funding.

We conduct thorough Due Diligence and Impact assessment of all businesses that are seeking capital from us.

In some cases our partner company, One10, will provide Capacity Building Programs to prospective enterprises prior to the Due Diligence phase to improve their investability.

We seek to create value beyond our initial investment by providing active support to the portfolio companies.

We actively manage our portfolio for best value creation, returns and long term impact.

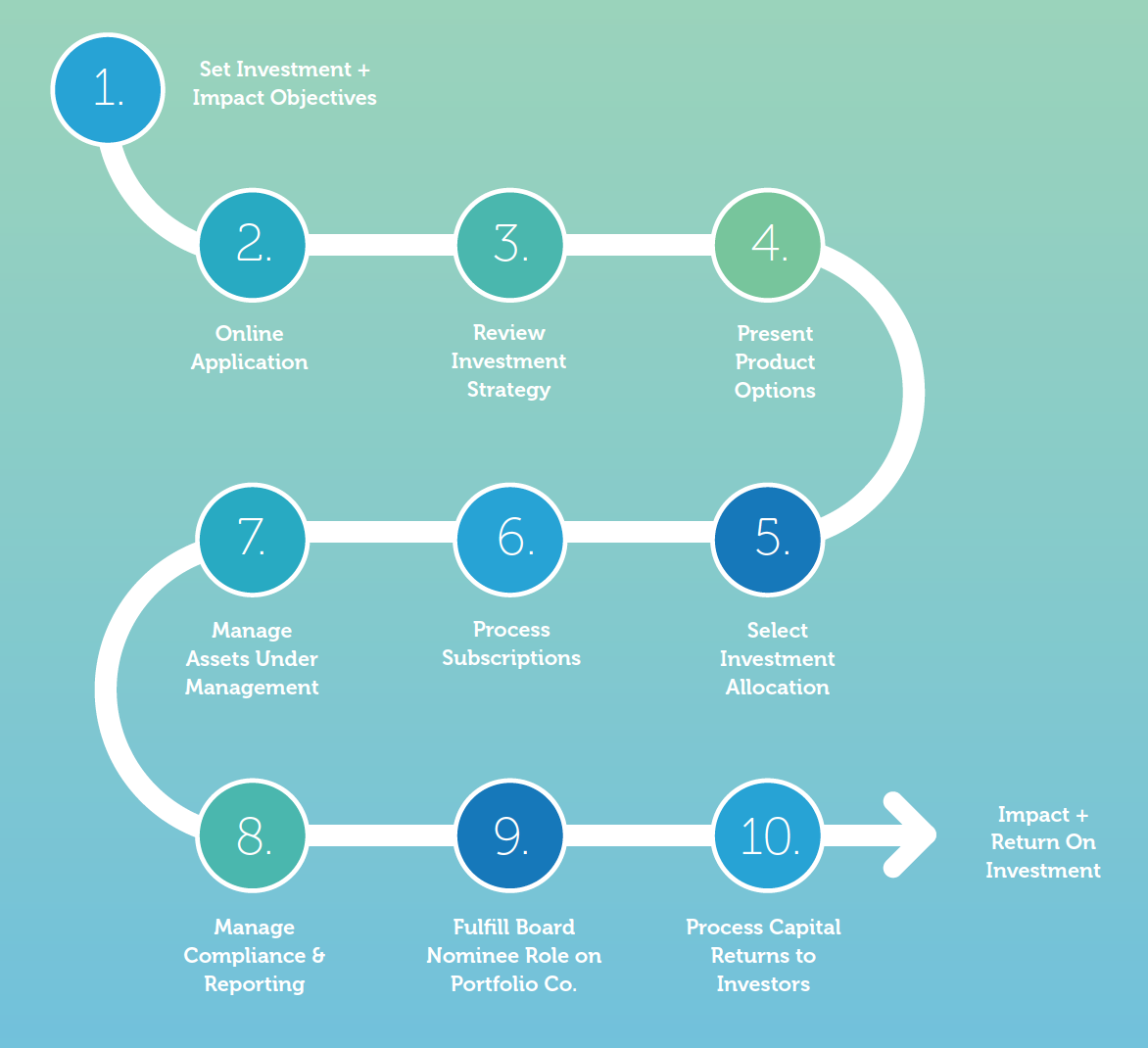

Impact Investment Process

Investor View of Impact Investment Process

United Nations Sustainable Development Goals (SDG)

Through our Founders past experience, as a Board Director of the United Nations Association of Australia (UNAA), Impact Investment Fund has adopted the use of the Sustainable Development Goals #GlobalGoals, in aligning our investment focus to actively seek investments across all 17 Goals.

17 Goals to Transform Our World

In 2015, countries adopted the 2030 Agenda for Sustainable Development and its 17 Sustainable Development Goals. In 2016, the Paris Agreement on climate change entered into force, addressing the need to limit the rise of global temperatures.

Governments, businesses and civil society together with the United Nations are mobilizing efforts to achieve the Sustainable Development Agenda by 2030. Universal, inclusive and indivisible, the Agenda calls for action by all countries to improve the lives of people everywhere.

You can view each goal here.

Image Credit: http://www.un.org/sustainabledevelopment/