Advisory Services

Impact Investment Fund offers a range of advisory services to support our investors needs. We advise on Impact Portfolio Strategy and Development, Investment Strategy and Implementation, and Investment Spectrum and Environmental, Social and Governance Principles. If you are new to Impact Investing, or simply want to discuss how your portfolio can be aligned to your values, contact one of our advisory team.

Impact Portfolio Strategy and Development

The first place to start in building an Impact Based Portfolio is to undertake a critical review of your current investment portfolio and identify any negative, positive or ESG screens in place. We then consider your personal financial and impact goals and develop a strategy and future investment plan.

In some situations portfolio alignment will require divesting from non-impact or negative investments (ie Fossil Fuel) and seeking out positive investment opportunities to take their place.

Our team are experts in portfolio management and are here to support you every step of the way.

Investment Strategy and Implementation

We work with our investors to determine the most appropriate investment strategy for their short, mid and long-term objectives. We add further value by connecting their investment capital to a range of funds and investments that align to their objectives, values and wealth creation targets.

Our team then manages the implementation of the investment strategy and future reporting, monitoring, administration, compliance and governence.

Principles for Responsible Investment (PRI)

PRI Mission

“We believe that an economically efficient, sustainable global financial system is a necessity for long-term value creation. Such a system will reward long-term, responsible investment and benefit the environment and society as a whole.”

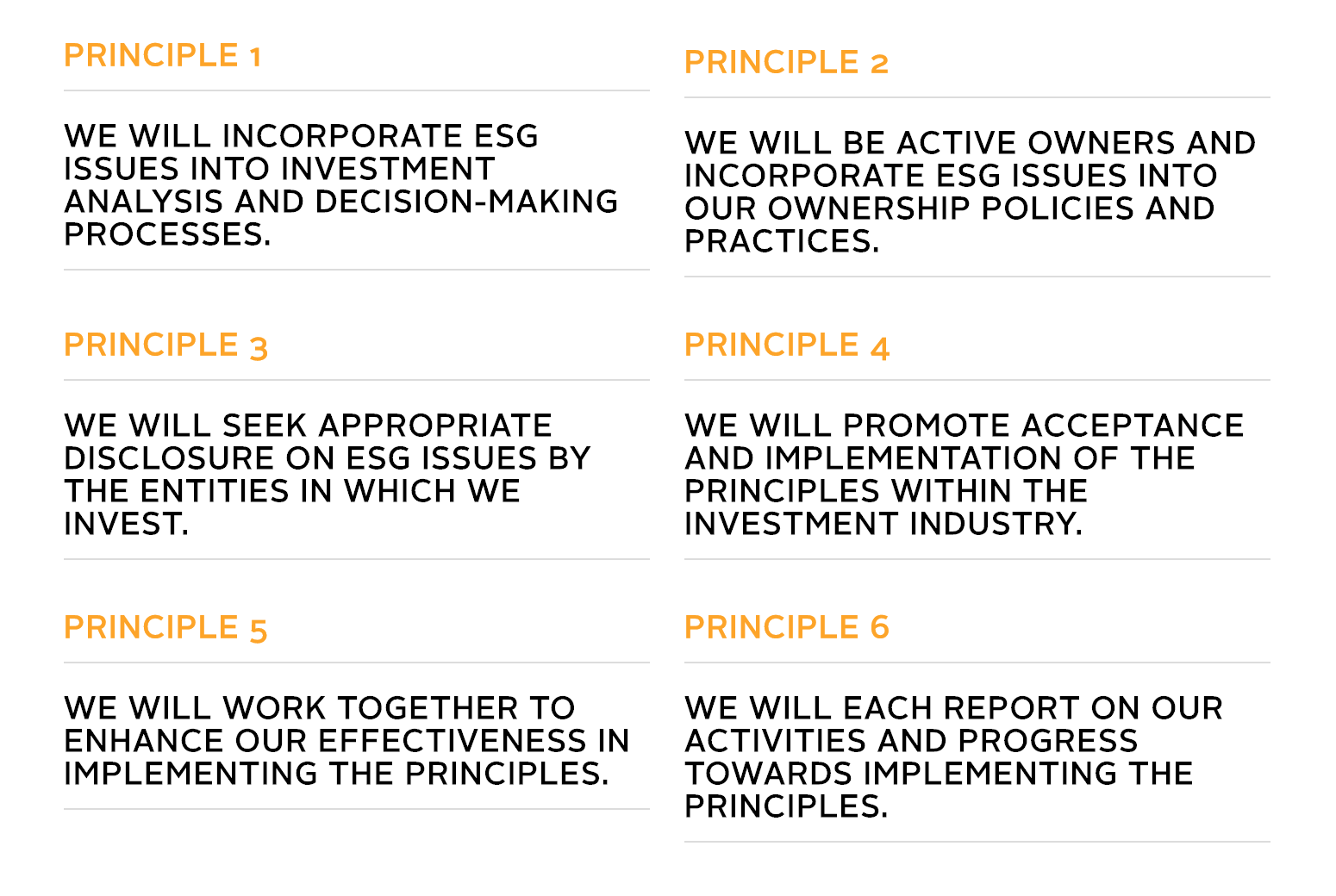

Six Principles

The six Principles for Responsible Investment are a voluntary and aspirational set of investment principles that offer a menu of possible actions for incorporating ESG issues into investment practice.

The Principles were developed by investors, for investors. In implementing them, signatories contribute to developing a more sustainable global financial system. They have more than 1,750 signatories, from over 50 countries, representing approximately US$70 trillion.

Source: https://www.unpri.org/about/the-six-principles

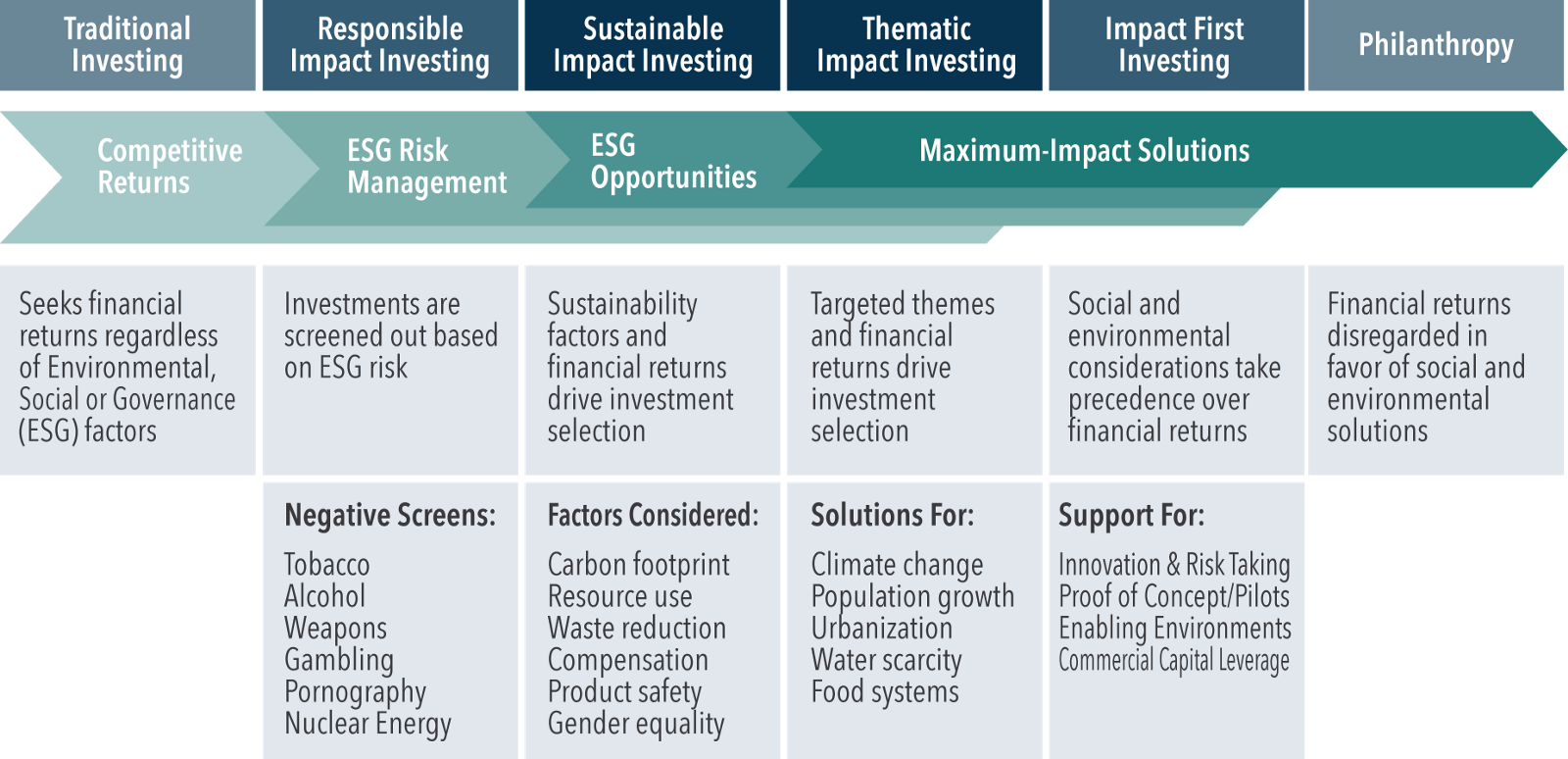

Investment Spectrum & ESG Integration

Adapted:The Bridges Spectrum of Capital.